The missing link to solving DATEV API integration challenges

- Dr. Themo Voswinckel ⎪Co-Founder

- Feb 12, 2025

- 1 min read

Updated: Mar 12, 2025

Why every software conquering Germany needs a DATEV API integration – and how to make It work

Time to unlock the key to seamless financial integrations for your software team.

If your software team operates in Germany, integrating with DATEV API has become essential. With over 90% of tax advisors and 8M+ businesses relying on DATEV, a lack of integration means manual work, inefficiencies, and potential customer churn.

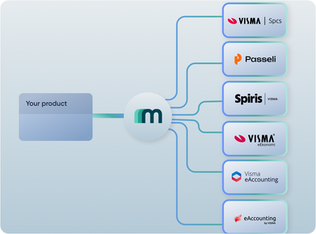

Join Themo from Maesn, the expert in accounting/ERP SaaS integrations, for a 20-minute deep dive into the importance of DATEV and how to integrate it successfully.

What you will learn on DATEV API integrations

Why DATEV is Crucial for German Financial Operations – Explore DATEV’s dominance, why tax advisors rely on it, and how non-integrated SaaS tools create inefficiencies with CSV exports, PDFs, and manual uploads.

Key SaaS use cases for DATEV API integrations – Automate transaction data transfers for FinTech & Accounting Software, enable seamless payroll processing with HR & Payroll Tools, and directly book invoices into DATEV via Rechnungsdatenservice for Invoicing & ERP Systems.

Navigating the DATEV Ecosystem – Understand DATEV Unternehmen Online (DUO), Rechnungswesen, and DMS, and learn which DATEV services align with different SaaS use cases for optimal integration.

The Technical side of DATEV API integration – Learn why DATEV APIs require manual activation via tax advisors, how SaaS providers can guide customers through the process, and follow a step-by-step checklist for a smooth integration.